Probably the main problem facing UBI right now is the lack of sink mechanisms for the token. Until now we’ve seen individual philanthropist contributions trying to decrease the supply of the token but the question of a mechanism designed to systematically burn tokens is still looking for an answer. This post proposes a mechanism that would delay the increase of the supply, giving us more time to burn UBI through other means.

Mechanism short summary

Everyone who burns UBI is rewarded with an increased amount of UBI dripping to their wallets for a certain period of time.

Extra supply

The heart of this mechanism is the idea of a single human receiving multiple basic incomes (2 UBI/hour instead of 1, for example). This might sound like the exact opposite of what we’re looking for (reduce UBI emission) but the increase on supply will be compensated with the tokens being burnt and then vested over time.

Details

The mechanism can be explained in 3 steps:

- Somebody loans to the protocol: A lender burns UBI. (let’s call that amount

ubi_burned.) - The loan gets paid: An additional amount of UBI drips to that wallet in a way that after some time (

roi_time) the wallet gets an amount of UBI equal toubi_burned. - Interests get paid: After

roi_timethere will be aprofit_timewhere the lender keeps getting extra issuance. The profit issuance will decrease with time until it reaches 0. After this, the lender goes back to receiving 1 UBI/hour.

The total issuance for a Human would look like this:

issuance = 1 + extra_issuance [ubi/hour]

The extra issuance per hour during the roi_time for a lender can be calculated with:

extra_issuance_roi = ubi_burned / roi_time[in hours]

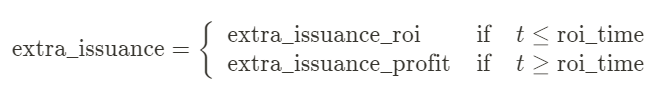

After the roi_time, the extra issuance would be a function that decays over time until it reaches 0 after a profit_time.

extra_issuance_profit = f(t)

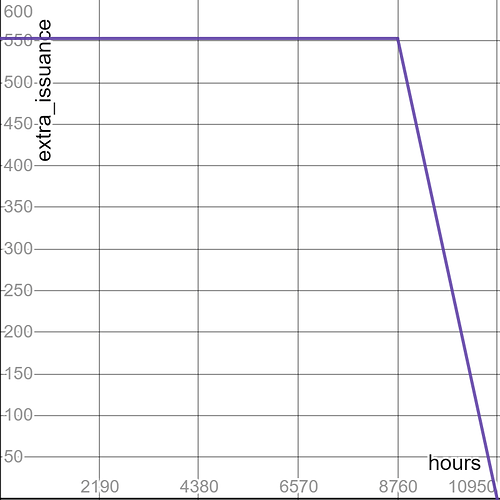

So, the extra issuance would look like this:

Example: UBI-punks

Alice want’s to launch her own NFT PFP project, UBI-punks, 10,000 NFTs, 0.01 ETH each, no royalties. That’s 100 ETH if it gets sold out. Alice decides to burn ~4,845,000 UBI with the 100 ETH she got from the sale.

Let’s define some values for the variables of the mechanism:

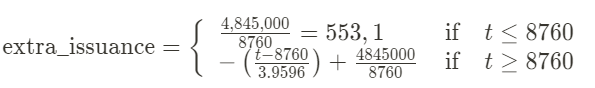

-

ubi_burned4,845,000 -

roi_time8,760 (one year) -

profit_time2,190 (one quarter) - $f(t)=-t$ (the profits decay using a simple linear function)

The mechanism sets the extra_issuance for Alice:

After 5 quarters, Alice gets 5,450,644 UBI (605,644 UBI more than if she just have bought and hold when she got the 100 ETH, a 12% profit).

Analysis

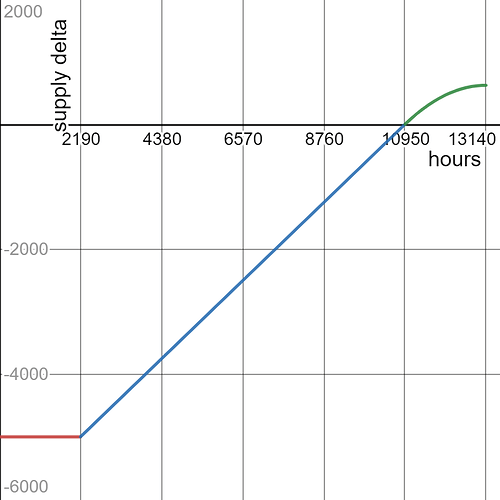

The token supply during the duration of a loan compared to the supply if no loan was taken would look like this (here 5000 UBI were burned somewhere in the first quarter):

You might notice that at the end the supply still increased compared to no loan. This is a tradeoff worth taking: The supply decreases for some time but there will be more tokens far in the future.

With this set of parameters the protocol will be at profit for 4 quarters (blue line), during this time other burning mechanisms would burn the extra supply that would be used to pay for the loan interests (green line).

This other burning mechanisms can come from multiple places but some examples are:

- Money raised from a Gitcoin grant.

- The UBI vaults.

- Individual contributions.

- Other loans. (eg. Alice loans UBI during Q1 but in Q3, before her profit period starts, Bob starts a loan the same size.)

So, this mechanism will keep a negative delta on the supply of the token as long as: People keep lending and//or the other burning mechanisms keep decreasing the supply of the token.

For this reasons I consider this mechanism to be beneficial to the protocol.

Final notes

The parameters used for the mechanism in the example are arbitrary. The real values of the protocol are open for discussion (just as everything else). For example, if a 12% yield is too high for the other burning mechanisms to keep pace, the yield time can be increased or the profit function can be modified to decrease faster (eg. quadratically or exponentially).

The protocol would be greatly benefited if the size of the vaults increase, a fee can be implemented on the loans in a way that a certain % goes to the vaults.