So… in an ideal world:

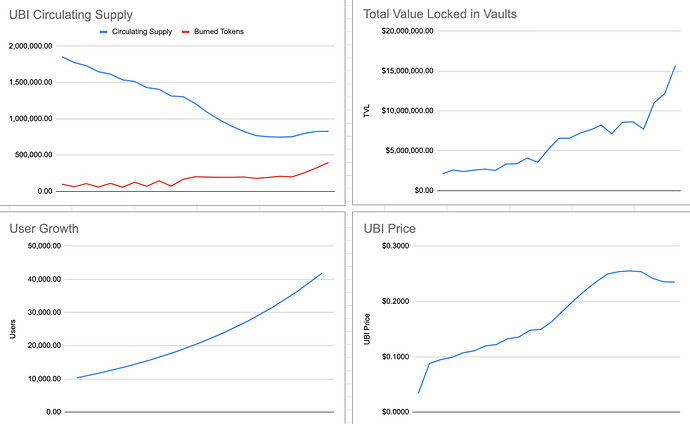

In order to understand how we can sustain and potentially grow the price of the UBI token, it is clear that we need consistent mechanisms that burn circulating supply of the token. For this reason, I worked on a simulation to understand how we can make the best use of the vaults that currently hold DAI & ETH and use yield to burn UBI tokens: UBI Simulation - Google Sheets

There’s a couple of key outtakes from this exercise:

-

We need to find mechanisms that prevent circulating supply to reach Uniswap or any Dex:

Ideally we grow the utility of UBI (UIP-1 and UIP-2 are moving forward nicely), but also if we want someone to exchange UBI for ETH or DAI… it’s probably better to incentivize them doing the swap for ubiETH or ubiDAI. -

We need significant liquidity in the vaults.

Right now these are capped at $1M DAI and 400 ETH max. Reaching those numbers relatively quickly will be extremely helpful. A logical first step that recently got approved with HIP 29 is putting our own DAO funds in the vault so we can later persuade other DAOs to follow our example. -

User growth means more UBI supply which inversely correlates with price.

How can we align the interest of having more users with impacting positively the price of UBI? A quick idea could be that the 0.128 ETH used as a deposit gets returned back to the user directly as ubiETH on the vault. But we clearly need more ideas around this and how UBI and PoH can interplay. -

Tokenomics need to evolve.

I’m definitely looking forward to @Mads pol.is poll to see how we are standing as a community on this subject. Some kind of bonding curve mechanism that can align UBI issuance to price or supply could have an interesting impact in the future… now is probably the best moment to start re-thinking how issuance works for UBI.

I think that PoH needs a successful UBI to attract more users… and UBI needs an optimized PoH so it can impact more lives and expand its utility. Feel free to play with the simulation and contribute to the brainstorm here.