Hello, fellow Humans (I swear I am even though I’m not verified!),

Originally made a new topic before realizing this should go here  This post is lengthy as it is an exploration of an idea… so first TL;DR: I am concerned that a flat-rate issuance model with no formal mechanism to cap supply doesn’t give UBI a sustainable future. I This post outlines some of the number I looked at for the current UBI distribution method and an alternate method with issuance proportional to population. In the alternate model, issuance is funded it through a flat tax rate on all accounts and supply is fixed. It acts as a fair distribution model that trends toward equality over time. Additionally, humans could be incentivized to hold their tokens despite the tax by rewarding them 1:1 with a non-transferable token, like a reputation token, for every UBI taxed.

This post is lengthy as it is an exploration of an idea… so first TL;DR: I am concerned that a flat-rate issuance model with no formal mechanism to cap supply doesn’t give UBI a sustainable future. I This post outlines some of the number I looked at for the current UBI distribution method and an alternate method with issuance proportional to population. In the alternate model, issuance is funded it through a flat tax rate on all accounts and supply is fixed. It acts as a fair distribution model that trends toward equality over time. Additionally, humans could be incentivized to hold their tokens despite the tax by rewarding them 1:1 with a non-transferable token, like a reputation token, for every UBI taxed.

I was ecstatic when I learned about this project a few weeks ago. I’ve followed a few different projects trying to establish a Proof of Humanity, but this is the first I’ve seen that actually seems sustainable (outside of the current gas prices). My biggest concern after reading and learning more about the project is how distributing value is sustainable over the long term. Regardless of what we want out of UBI, math doesn’t lie and an infinite-supply currency will continue to have less value to other fixed supply items. I am worried that the current model puts a majority of that inflationary burden on the future in the form of sustained token price decreases. What if we could establish tokenomics that would instead explicitly discount the past token supply to keep the future constant?

Currently, UBI is mostly reliant on decreasing supply through burning. I’ve seen past posts here and even a tweet from Vitalik that points out the need for more “sinks” for the UBI token to maintain its value. In my view, these sinks are two-fold. “Temporary sinks” that freeze or take tokens out of circulation by various use cases (i.e. voting mechanisms, staking, other social layers) and “permanent sinks” like burning or recirculating tokens into issuance. What I am going to discuss below is more about “permanent” sinks related to the token supply dynamics, though (as I have seen addressed in other threads) utility on the network will be key in keeping up demand to make any sort of UBI model sustainable.

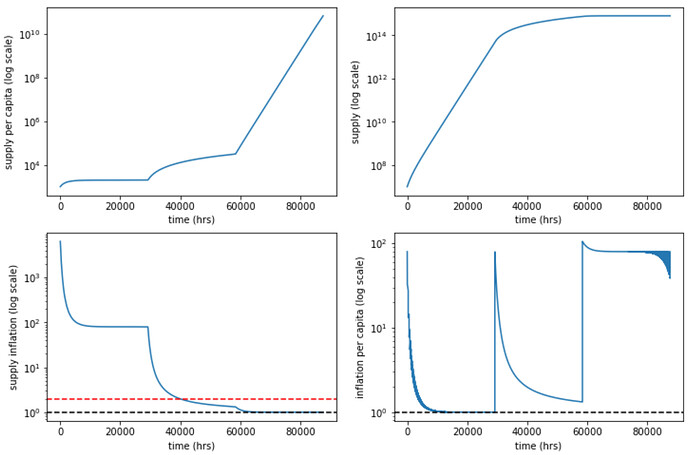

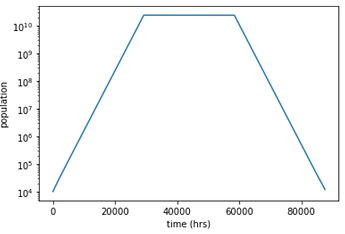

As a start I want to share some simple modeling about how the inflation rate of UBI changes with time and population growth on the network. POH has one distinct advantage when it comes to exploring different token models - we know the number of registered humans on the network! While this isn’t a perfect proxy for demand, I imagine it is a better direct proxy than we have for most other currencies. In figure 1, I generated a really simple model with 3 periods of growth (accelerating, flat, and decelerating) and made a few observations about the inflation rate (both supply inflation and adjusted per capita). Over time, the inflation rate of the total supply steadily decreases as the time passes. More interestingly, the inflation of supply per capita of every registered human (adjusted for our demand proxy) is greatest when the total supply is low and population growth is low. It is highly-dependent on both time and population growth. Somewhat counter-intuitively the inflation of supply per capita actually decreases with higher population growth. As more people join the network and there is more demand the amount of tokens per person is reduced relative to the inflation per capita at a slower growth rate. This trade-off is interesting, but seems to be reliant on growth to sustain value.

Fig. 1 - Very simple model of current UBI future issuance to test sensitivities to time and population growth over a period of 5 years. Assumptions: 1 UBI per hour, initial population of 10,000, and initial supply of 10,000,000. Inflation rate is front loaded and becomes small as time increases. This could hint that slowing population growth (as proxy for demand) may exacerbate the supply issues later in the life of this project

So, this is what I see as the problem: If the inflation rate per capita is very positive how can we expect to a flat rate issuance to serve its purpose of issuing value to humans over time?

Looking at these metrics got me thinking that alternative supply models could help to limit the perceived inflation rate. What I eventually determined is that the most elegant solution to this problem could be a fixed supply currency that is constantly taxed at a fixed flat rate with all the proceeds distributed equally amongst all humans. This effectively takes the future inflation problem and discounts account values to account for the impact. The tax rate effectively becomes the rate at which you devalue issued tokens to issue new ones and can be scaled higher or lower depending on whether the community values savings or fair distribution more. For completeness, below are the 4 models that I experimented with before ending up on this taxation model:

- Current model (fig. 1) of no supply limit and constant issuance (1 UBI per hour)

- Model of fixed supply and constant issuance (1 UBI per hour) supported by a changing tax on all accounts: has a significant issue that the tax (or forced burn rate) grows very high as the population gets larger.

- Model of changing supply (proportional to population) with a changing burn rate to support constant issuance (1 UBI per hour)

- And finally, fixed supply with variable issuance and a fixed tax rate. Issuance is determined by the tax rate and number of humans as

total supply * turnover rate / population

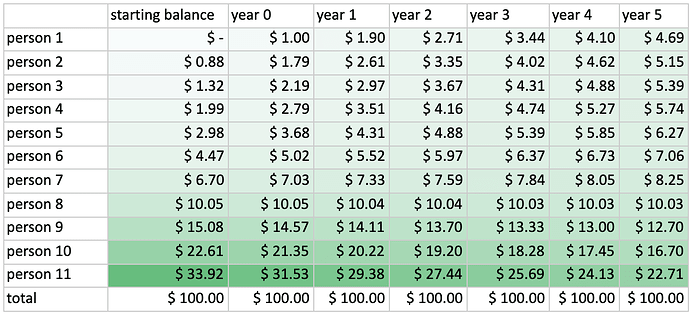

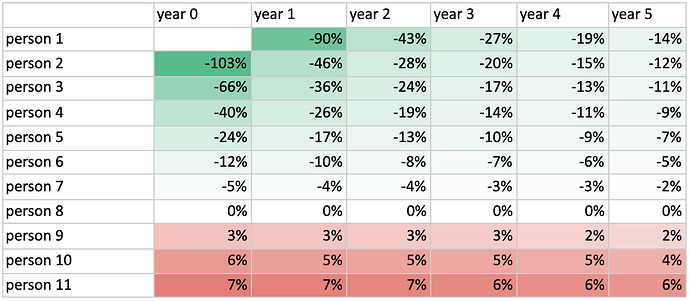

where the turnover rate is the same as a tax rate. I like turnover because it makes it clear that the tokens are being reissued immediately. Tables 1-3 show a couple very simple examples of how this mechanism plays out with multiple accounts. This mechanism of UBI + flat tax rate acts similarly functions like an effectively progressive tax on all accounts to sustain UBI issuance to all humans. The tax/turnover rate could easily be set by the DAO (e.g. 0.00120274% per hour or 10% per annum).

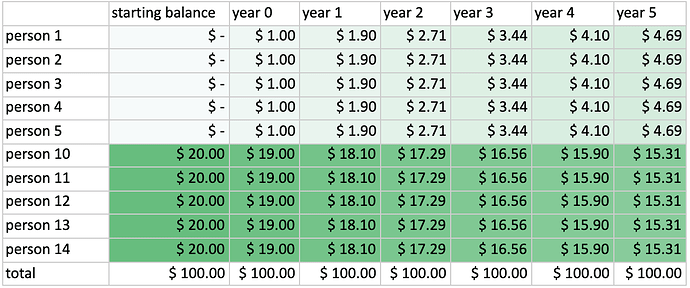

Table 1 - Assuming a fixed supply model where each account is adjusted at each time-step by the formula “new account value = previous account value * (1 - tax rate) + total supply * tax rate / population”. This formula is assessed to an uneven distribution over 5 time-steps assuming a tax rate of 10% per annum.

Table 2 - Effective tax rate for each account per time step calculated from table 1. This makes it clear that the simple model of UBI + tax is similar to a progressive tax system with a negative income tax.

Table 3 - Second example model showing the impact of the same model used in table 1 on a population that had an even distribution but then doubled in size.

The final model is really interesting because it accounts for the time aspect of the UBI token and population aspects of the UBI network directly in the issuance model. Time is no longer an issue because the supply is fixed and each human’s new share of the network is funded by taxing the existing network. Another convenient aspect is that the issuance amount is inversely proportional to population and should scale with potential demand - if demand is high, price is high, less issuance is needed.

Lastly, one possible method to incentivize holding that would be possible in this system (and has been discussed here) is to introduce a second non-transferable utility token that is accrued 1:1 with the amount of UBI taxed from an account. This “reputation” token could potentially be used (staked, delegated, or burned) as a utility token for applications and would provide an incentive for a user to allow their UBI holdings to be taxed.

I believe UBI is bound to have a value trade-off over time - it will either be expressed as inflation or we can explicitly time-discount each unit of account in UBI equally and treat every issuance as a fresh start. Of the token models I played around with, this issuance/taxation model seems the most simple and most elegant, but still adds complexity to the system, especially with the addition of a second token. Will be curious to hear feedback on this spitball idea and I’m excited to be part of this fantastic community!