We’re fully funded we don’t need to pump and dump our token is free and our system is built. You’re free to believe whatever you will but the fact remains our governance model doesn’t require purchase of the token. So i’m sorry that dissapoints you sir

gracias por desasnarme jajajaja crei que hablaban de ET jajja

N = cuentas potenciales

R = tasa de crecimiento de la comunidad

Fp= total de cuentas

Ne = total de cuentas falsas detectadas

Fl = los perfiles que solo cumplen con algunos de los parámetros de las cuentas falsas

Fe= los que comparten todos los parámetros de las cuentas falsas

L= tiempo

algo así sin estrellas ni planetas jajajajja

que dificil debe ser … después de una hs creo que mas o menos entendi de que va la conversacion . jajaja gracias

Dude,

Stop spamming off topics to push your own pet project.

Keep this topic around UBI/Tokenomics  cc @dogweather

cc @dogweather

That’s probabilistic Bayesian trap where we can punch guess numbers to output range 0.001-99.999%… try adding real world data in there with scaling, we’ll be back to square one of solving Sybil proof & byzantine generals problem. or BDFL @mykos!

We have < 3 gates in PoH. Is human unique? + is vouched by member? ~ true or false?

Deposit, gas cost and scalability are part of Sybil/BFT equation handled by eth chain.

It is clear to me that the price of UBI depends on the incomes which at this moment had been purely philantropic. As registered humans and times increase, more UBIs are issued and the “donations” are divided by more. Therefore the price of UBI drops constantly.

I suggest to change the 3.5 days entrance fee for a method of devolution till a new member is registered:

I.e: 100 people wants to register and do the deposit of 0,187 ETH. These ETH goes directly to the liquidity of UBI (the price increase). After these 100 people, 300 more wants to register: 100 goes for devolution of the initial batch and 200 deposits goes for new liquidity.

It is a pyramidal scheme but without interest and low risk (in fact with this method the entrance fee can be lower). The pyramid is only started as 6.000 poeple are registered and 7Billion is the max target.

This method can be added to other ideas like the Vault, more philantropics donations, etc.

I agree. In short, simply make the deposit UBI denominated.

I strongly disagree to carry this idea forward, this is exactly how the first piramid scheme worked …we should be patient, as new implementations get in production, the project will skyrocket by itself, imagine we even don’t have a pm and dev still…

Given the potential of UBI to become a massive universal basic income, I think it logical to implement mechanisms that accompany this growing issuance at par, otherwise the token will not achieve stability over time and will always tend to 0.

-

Burn: For this, 1% of each transaction made through UBI could be burned. The benefit would be that this will scale in conjunction with the PoH database, the more people who register and transact, the more it will burn.

This will benefit both those who transact several times out of necessity and those who maintain UBI since the result will always be a price appreciation. (I will not go into details on gas costs as it is not an intrinsic problem to UBI and we can trust that the Ethereum will do its job to stay competitive.) -

Liquidity: Adding the self-liquidity feature with another 1% commission could also be explored: using 0.5% to buy ETH or DAI and the other 0.5% from Ubi to lock them in a pool as a resolution to a possible long-term liquidity problem.

-

Adoption: I think it will be necessary for UBI to start mass adoption as well.

One way would be by trying to ally with widely accepted platforms such as Mercadolibre. However, being aware that UBI is a universal token, these measures are nothing more than local solutions to a global problem.

As a solution to this problem, I believe that in the future UBI should create its own wallet Android/iOS application with which receiving payments and sending payments in UBI is easier for any person or merchant. I think the success of the project depends largely on this app. since there is no other way to “universalize” UBI. Once the app is launched, its acceptance should not take too much trouble, so a market for transactions in UBI would have been developed without the need for advanced knowledge or to swap it for another currency and with a friendly interface.

We could establish that the new registers in PoH will be with the new address of the wallet / UBI which would work very similar to Metamask and old users should pass their UBIs manually if they want to use it.

I think this would be the steps to start talking about a future for UBI in long-term.

good morning . of course but to enter the project and pay the gas and the deposit, you need if or if ETH = USDT

what would happen if that deposit would be paid with UBI? the same as the Fee? then the FEE would be inside the project. POH and not eth and it would be logically strengthened.

why do you have to go out and buy ubi instead of eth.

I explain myself?

imagine that in the meantime the deposit the three and a half days can be put in the pool and also go giving liquidity and profitability?

and if you add to the project as well, an Exchange ( to get out of the way ( binance kukoin or whoever) great as well

you would generate an ecosystem dodne ser would strengthen UBI.

ve to change all the tutorials😂

Translated with www.DeepL.com/Translator (free version)

The main reason preventing people from investing in $UBI is the constant issuance rate per human, leading to unpredictable and ever increasing inflation. It could be improved significantly by changing issuance to a constant rate in total, meaning the more users, the smaller the drip rate. Inflation would be reasonable and predictable as a result, allowing it to be a viable investment for both ideological but also profit-driven investors.

But don’t forget, the purpose of UBI is to provide a universal income to everyone. It is not to be solely a speculative crypto.

I totally agree, but the two go hand in hand. With the current rate of 1 UBI per hour it’s kind of a black hole to invest or hold on to the coins right now, as any holding gets heavily diluted the more people join. Which is unfortunate because the underlying tech is awesome and could easily achieve a multi billion $ marketcap.

Having a fixed rate of 1 UBI per hour isn’t really doing anybody a favor… As a recipient I’d rather get like 0.142 UBI at 50$/UBI instead of 1 UBI at 0.03$/UBI

I understand what you mean. I suspect this issue was discussed long and hard when the tokenomics were being decided. No doubt it’s in a white paper somewhere that I haven’t read.

The decided path for the developers is the Vault where you provide DAI at 7% staking rate, you receive 3,5% and you donate 3,5% for the burning of UBI’s. The front faces of this project must increase the public relations to get more and more funds to this vault.

Being that PoH is a DAO there isn’t really a decided path or “developers”. Several options are being pursued by different contributors.

-

The vault was spearhead by @santisiri and is a major part of the way forward. It is gaining steam, the $ubiDAI already has over $200,000. It is believed that $ubiETH deposits will grow even faster. We could always use more marketing.

-

Another solution being pursued is issuance. Proposals for changing issuance are being worked on. This is taking some time because crypto economic experts and investors are being included.

-

Several utility apps are underway. We are supporting devs building PoH/UBI use cases. One I am excited about is @juanu’s Posta (previously Humanitweet). These projects will support by using UBI as the currency and burning part of it.

-

Many other ideas are being vetted - I don’t want to share prematurely because they aren’t mine.

All of the above are being lead by a mix of humans. A thriving UBI will be supported by many solutions.

Hello, fellow Humans (I swear I am even though I’m not verified!),

Originally made a new topic before realizing this should go here  This post is lengthy as it is an exploration of an idea… so first TL;DR: I am concerned that a flat-rate issuance model with no formal mechanism to cap supply doesn’t give UBI a sustainable future. I This post outlines some of the number I looked at for the current UBI distribution method and an alternate method with issuance proportional to population. In the alternate model, issuance is funded it through a flat tax rate on all accounts and supply is fixed. It acts as a fair distribution model that trends toward equality over time. Additionally, humans could be incentivized to hold their tokens despite the tax by rewarding them 1:1 with a non-transferable token, like a reputation token, for every UBI taxed.

This post is lengthy as it is an exploration of an idea… so first TL;DR: I am concerned that a flat-rate issuance model with no formal mechanism to cap supply doesn’t give UBI a sustainable future. I This post outlines some of the number I looked at for the current UBI distribution method and an alternate method with issuance proportional to population. In the alternate model, issuance is funded it through a flat tax rate on all accounts and supply is fixed. It acts as a fair distribution model that trends toward equality over time. Additionally, humans could be incentivized to hold their tokens despite the tax by rewarding them 1:1 with a non-transferable token, like a reputation token, for every UBI taxed.

I was ecstatic when I learned about this project a few weeks ago. I’ve followed a few different projects trying to establish a Proof of Humanity, but this is the first I’ve seen that actually seems sustainable (outside of the current gas prices). My biggest concern after reading and learning more about the project is how distributing value is sustainable over the long term. Regardless of what we want out of UBI, math doesn’t lie and an infinite-supply currency will continue to have less value to other fixed supply items. I am worried that the current model puts a majority of that inflationary burden on the future in the form of sustained token price decreases. What if we could establish tokenomics that would instead explicitly discount the past token supply to keep the future constant?

Currently, UBI is mostly reliant on decreasing supply through burning. I’ve seen past posts here and even a tweet from Vitalik that points out the need for more “sinks” for the UBI token to maintain its value. In my view, these sinks are two-fold. “Temporary sinks” that freeze or take tokens out of circulation by various use cases (i.e. voting mechanisms, staking, other social layers) and “permanent sinks” like burning or recirculating tokens into issuance. What I am going to discuss below is more about “permanent” sinks related to the token supply dynamics, though (as I have seen addressed in other threads) utility on the network will be key in keeping up demand to make any sort of UBI model sustainable.

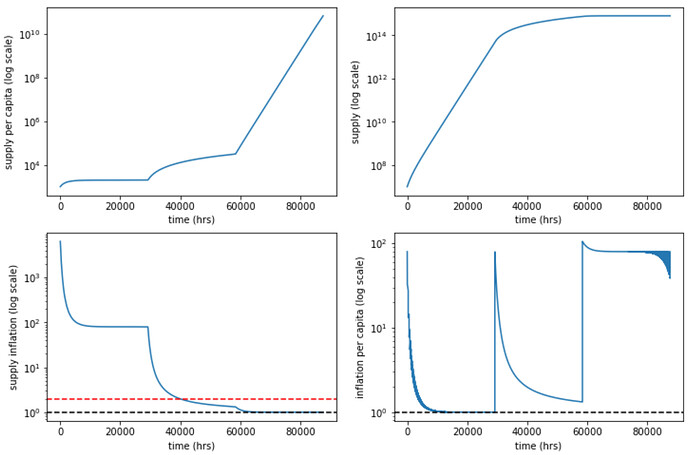

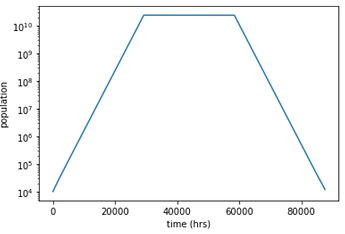

As a start I want to share some simple modeling about how the inflation rate of UBI changes with time and population growth on the network. POH has one distinct advantage when it comes to exploring different token models - we know the number of registered humans on the network! While this isn’t a perfect proxy for demand, I imagine it is a better direct proxy than we have for most other currencies. In figure 1, I generated a really simple model with 3 periods of growth (accelerating, flat, and decelerating) and made a few observations about the inflation rate (both supply inflation and adjusted per capita). Over time, the inflation rate of the total supply steadily decreases as the time passes. More interestingly, the inflation of supply per capita of every registered human (adjusted for our demand proxy) is greatest when the total supply is low and population growth is low. It is highly-dependent on both time and population growth. Somewhat counter-intuitively the inflation of supply per capita actually decreases with higher population growth. As more people join the network and there is more demand the amount of tokens per person is reduced relative to the inflation per capita at a slower growth rate. This trade-off is interesting, but seems to be reliant on growth to sustain value.

Fig. 1 - Very simple model of current UBI future issuance to test sensitivities to time and population growth over a period of 5 years. Assumptions: 1 UBI per hour, initial population of 10,000, and initial supply of 10,000,000. Inflation rate is front loaded and becomes small as time increases. This could hint that slowing population growth (as proxy for demand) may exacerbate the supply issues later in the life of this project

So, this is what I see as the problem: If the inflation rate per capita is very positive how can we expect to a flat rate issuance to serve its purpose of issuing value to humans over time?

Looking at these metrics got me thinking that alternative supply models could help to limit the perceived inflation rate. What I eventually determined is that the most elegant solution to this problem could be a fixed supply currency that is constantly taxed at a fixed flat rate with all the proceeds distributed equally amongst all humans. This effectively takes the future inflation problem and discounts account values to account for the impact. The tax rate effectively becomes the rate at which you devalue issued tokens to issue new ones and can be scaled higher or lower depending on whether the community values savings or fair distribution more. For completeness, below are the 4 models that I experimented with before ending up on this taxation model:

- Current model (fig. 1) of no supply limit and constant issuance (1 UBI per hour)

- Model of fixed supply and constant issuance (1 UBI per hour) supported by a changing tax on all accounts: has a significant issue that the tax (or forced burn rate) grows very high as the population gets larger.

- Model of changing supply (proportional to population) with a changing burn rate to support constant issuance (1 UBI per hour)

- And finally, fixed supply with variable issuance and a fixed tax rate. Issuance is determined by the tax rate and number of humans as

total supply * turnover rate / population

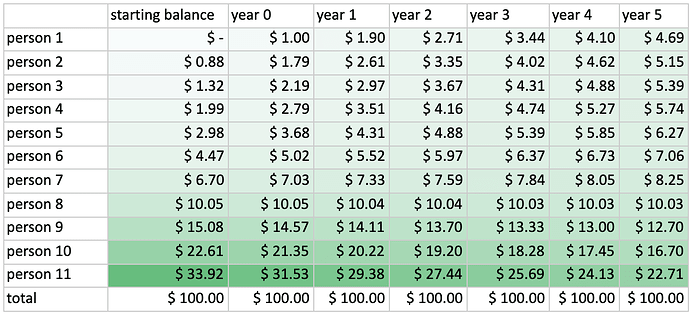

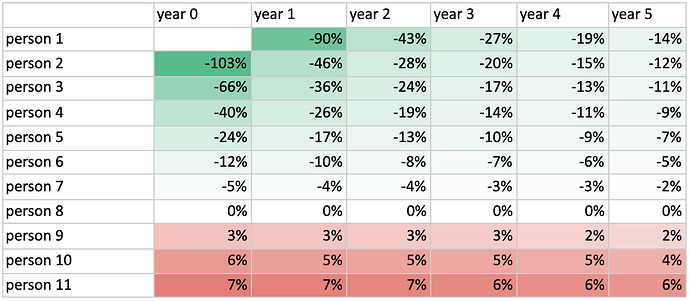

where the turnover rate is the same as a tax rate. I like turnover because it makes it clear that the tokens are being reissued immediately. Tables 1-3 show a couple very simple examples of how this mechanism plays out with multiple accounts. This mechanism of UBI + flat tax rate acts similarly functions like an effectively progressive tax on all accounts to sustain UBI issuance to all humans. The tax/turnover rate could easily be set by the DAO (e.g. 0.00120274% per hour or 10% per annum).

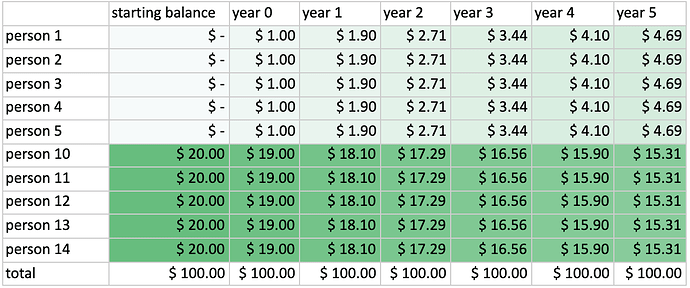

Table 1 - Assuming a fixed supply model where each account is adjusted at each time-step by the formula “new account value = previous account value * (1 - tax rate) + total supply * tax rate / population”. This formula is assessed to an uneven distribution over 5 time-steps assuming a tax rate of 10% per annum.

Table 2 - Effective tax rate for each account per time step calculated from table 1. This makes it clear that the simple model of UBI + tax is similar to a progressive tax system with a negative income tax.

Table 3 - Second example model showing the impact of the same model used in table 1 on a population that had an even distribution but then doubled in size.

The final model is really interesting because it accounts for the time aspect of the UBI token and population aspects of the UBI network directly in the issuance model. Time is no longer an issue because the supply is fixed and each human’s new share of the network is funded by taxing the existing network. Another convenient aspect is that the issuance amount is inversely proportional to population and should scale with potential demand - if demand is high, price is high, less issuance is needed.

Lastly, one possible method to incentivize holding that would be possible in this system (and has been discussed here) is to introduce a second non-transferable utility token that is accrued 1:1 with the amount of UBI taxed from an account. This “reputation” token could potentially be used (staked, delegated, or burned) as a utility token for applications and would provide an incentive for a user to allow their UBI holdings to be taxed.

I believe UBI is bound to have a value trade-off over time - it will either be expressed as inflation or we can explicitly time-discount each unit of account in UBI equally and treat every issuance as a fresh start. Of the token models I played around with, this issuance/taxation model seems the most simple and most elegant, but still adds complexity to the system, especially with the addition of a second token. Will be curious to hear feedback on this spitball idea and I’m excited to be part of this fantastic community!

Hi @armstrys, welcome to the community!

This is a very interesting post. We’ve been thinking about potential taxing to the token since we’ve seen simulations that even though you might have a fair distribution, over the long term whales end up monopolizing the market.

The idea of using a tax to re-issue tokens as a way to combat inflation makes plenty of sense to me. It would be interesting to see this formalized into a UIP and specifically discussed.

Having a cap is also interesting in the sense that would help meme out there in a similar way to bitcoin. Bottom line is not how many UBIs a person receives, but how much value ($$$) a person gets. So I’m definitely open to explore this.

Do you have this model on an open spreadsheet so we can tinker with it?

I think that the time to improve our issuance model has come. Today we are barely 10k humans, but we must be ready for 100k which could happen sooner than we expect it.

Sure thing! Very simple spreadsheet here. Let me know if you have trouble accessing it - I added a short page up front with the formulas since the model would be very easy to rebuild in a more flexible way for people who do this more often than I do!

Hi Armstrys.

From an economic perspective, taxation and inflation are the same.

I.e the economic effect of reducing balance of everyone by 10% is the same as creating an extra 11% of tokens.

The former allows interoperability with other apps (exchanges, bridging to other platforms, etc) while the later breaks it and makes accounting way harder.

That trade-off makes sense to me, but for the two to really be equivalent don’t you need to also inflate the issuance? Without doing that the issued value will just keep dropping won’t it? You’re probably right that there is a much simpler solution in terms of accounting, but it seems to me that the trade-off is accepting a forever dropping token price and increasing issuance to balance it out.