Hey Humans!

I’ve been thinking with @RoboTeddy and @Justin about UBI’s issuance rate and am creating a separate thread here so we don’t mix this discussion with other tokenomic-related ideas.

Ok, so clearly we have a problem:

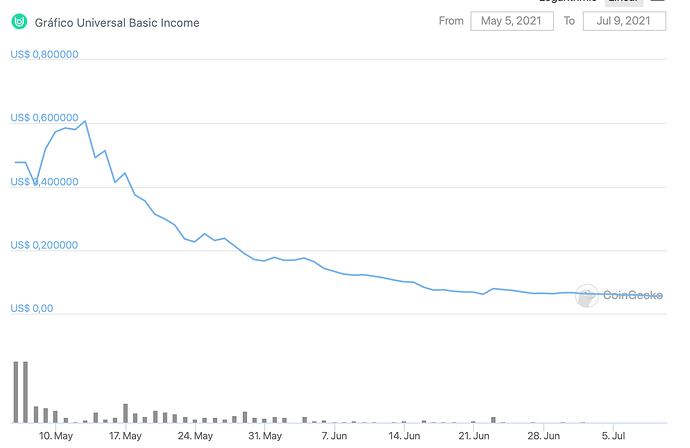

[ $UBI price graph ]

Both from a security and organizational perspective, sustaining the price of UBI is critical for Proof of Humanity to achieve its ambitious goals.

Today, 1 UBI is valued at $0.05 USD, a result of an ongoing decay in price since the project was first launched. Our current issuance model mints 1 UBI per hour, per member of the registry. The math behind its valuation is simple: the value invested in UBI must be greater than the amount being cashed out by new and existing recipients, otherwise the price will continue to decrease.

Currently, all investments come from buys on the UBI/DAI & UBI/ETH liquidity pools. There’s an additional path to accruing value, through a yearn vault that buys and burns UBI with half of the yield it generates. However, as the community of recipients grows (as of now, we are the fastest growing personhood protocol ever launched), we need more robust mechanisms to constrain sales and also counterbalance them with increasing investments, thus sustaining the price. Below we have outlined a few guiding questions for us to consider, which can help frame this discussion; and a few possible approaches to addressing these questions:

Guiding Questions

-

We know that there are dozens of potent use cases for Proof of Humanity, which will increase the utility of UBI. But building this thriving ecosystem will take time. How do we ensure that the price is sustained at this initial stage, before we get there?

-

Can we create mechanisms that incentivize recipients to hold and/or re-invest their coins into either the pools or the yearn vault?

-

Can we create financial incentives for new members to join as early as possible, helping bootstrap the network?

-

How can we make UBI more attractive to investors?

Progressively decreasing inflation

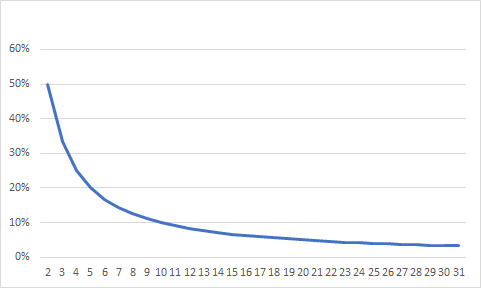

There have been different proposals about how to address these questions, and all of them should be explored. That said, up until this point we have found that all of the models which effectively address the 4 questions above fall under the category of progressively decreasing inflation. Here’s our reasoning:

There will always be some number of recipients that immediately sell their UBI allocation. Especially those for whom the $ amount of it has a measurable impact on their lives, which is a significant number given most members are coming from Latin America. However, both "recipients who can hold” and “investors willing to take a risk” can be grouped under a speculative value. For these groups, the incentive to sell only exists if they believe UBI will be worth less tomorrow. Conversely, the incentive to buy or hold increases if they believe it will be worth more in the future.

Thus, a progressively decreasing inflation model seems to make most sense, as it makes speculation attractive. We should design a framework where both investors and recipients can look at the tokenomics of UBI and make a reasonable prediction that the value is going to increase.

Possible models

Here are some possible paths to address the Guiding Questions. These are meant to kickstart a conversation rather than suggest a fixed solution:

*** Decreasing inflation according to the number of registered members on Proof of Humanity:**

| 1-100k members | 1 UBI per hour |

|---|---|

| 100-500k members | 1 UBI per day |

| 501-1M members | 1 UBI per week |

| >1M members | 1 UBI per month |

The table above suggests an arbitrary outline to exemplify the model, but there are probably more rigorous methods to determine these values, which a tokenomics expert could supply (perhaps estimating the value provided by a network of each of these sizes, using other cryptocurrencies as a reference).

- Decreasing inflation over time

| Year 1 | 1 UBI per hour |

|---|---|

| Year 2 | 1 UBI per hour |

| Year 3 | 1 UBI per day |

| Year 4 | 1 UBI per week |

| Year 5 | 1 UBI per month |

This model increases predictability with clear deadlines, which might be reassuring for both investors and recipients willing to hodl. On the other hand, this approach assumes the growth of the network over a certain period of time, which makes it riskier than the first proposal.

- Tying issuance to a fixed number, and splitting it between every registered human.

This is how DOGE works. E.g. Every minute 10,000 UBI gets split between every registered human. From a speculative perspective having the issuance fixed makes UBI appear like a more traditional token, meaning investors are more comfortable with the due diligence.

- [ Complementary approach ] Giving out locked-in bonuses for early users:

This model can be implemented in addition to the models above, and would specifically target question 1.b “Can we create financial incentives for new members to join as early as possible, to help bootstrap the network?”.

Here, early users would get a locked-in bonus. E.g. the first 10k people get X locked coins, the next 20k people get P locked coins. After 3 years, they can spend them.

Issuance Rate Workshop

Next Tuesday, July 13 at 11am ET, we will host a workshop with Albert Wenger, Chris Burniske and other professionals who will help us think through these questions, analyze some of the pros and cons of different issuance models.

I’m capping it at 30 participants so we can all speak and listen to each other. If you would like to join it, please sign up here - spots are on a first come first served basis.

→ Finally, if you would like to reply to this thread, please take the following points into consideration:

-

There are multiple ideas that can help sustain the price of UBI which do not directly involve the issuance rate (buying and burning systems, compelling challengers to reinvest their rewards, etc.). These are all valid and important but if you are going to submit them here, please make sure to mention explicitly how your ideas connect with the issuance rate, which is the lowest hanging fruit for us as a community.

-

If you would like to propose a different model for issuance rate that has not been outlined above, that’s wonderful! Make sure that the idea is as simple as possible, because (i) smart contracts are tough, and even implementing the simplest idea will entail a lot of complexity; and (ii) ideally this should be simple enough that a wide variety of stakeholders can make sense of it. Furthermore, in order to clarify how your proposal can help us solve the urgent challenges we are dealing with presently, please include an explanation of how your proposed issuance rate model addresses each of the four Guiding Questions, or include an explanation of why it is not addressing the questions (it is totally fine if you think that these are not the right questions to ask, just explain why).